Or don’t. It might be a good time to sell. Or not. It’s all quite perplexing.

How hot is the neighborhood real estate market? So hot that I got a letter from a Realtor the other day asking me if I wanted to sell my house. Which, frankly, seems about as likely as my being invited to a party at City Hall to celebrate all the good deeds that have been accomplished there.

That’s because I am about as real estate savvy as a billboard. I have missed every buying and selling opportunity in the housing market in the past 20 years, no matter how hard I tried and no matter what I did. I thought I had bought two houses over that period, only to come away without a house, but with a lot of paperwork and the vague idea that something had happened that I would never quite understand. Last year, I tried to refinance the home I finally did buy — with a damn good credit score, I might add — only to come away without refinancing, but with a lot of paperwork and the vague idea that something had happened that I would never quite understand.

In fact, I’m so fed up with homes and real estate that I have eagerly embraced a West Texas concept called the dyin’ house, as in, “This is the house I’m dyin’ in.” No need to worry about moving or home prices; all that’s required is to find someone who will clear everything out after I’m gone and not laugh too much at what they find, the detritus of what will hopefully be 70 or 80 years of writing.

Nevertheless, someone wants to put my house on the market because “the home inventory is critically low” in my part of town. Critically low? Who knew? Shouldn’t I be writing ferocious articles about something that is critical, calling sources and doing research? That I haven’t is yet another example of how this real estate thing confuses me.

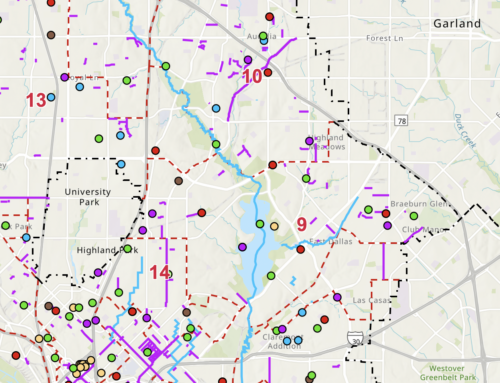

The one thing that does make me feel better is that the real estate run-up in East Dallas and Lakewood has been almost stealth-like over the past year or 18 months. One day, we were doing better than the rest of the country because our home prices hadn’t fallen as much as elsewhere during the recession, and the next day, inventory was at a critical level. Some experts have even said prices rose so quickly and so much that it’s almost time to worry about a crash. (Another advantage of the dyin’ house —who cares if there is a crash?)

There are two main reasons for our pricing good fortune, I’m told. Because, of course, I asked several real estate types, given my lack of real estate karma. First, there aren’t a lot of houses to begin with. Not only did the recession curtail new construction, teardowns and redevelopment of older areas, but we live in a part of town where there isn’t much empty land to build new houses on to begin with. We’ve got what we’ve got, and that’s it. Further complicating pricing is that more people want to live here than ever, which means that demand has increased while supply has remained static. That’s pretty much the classic definition of a real estate boom.

Second, mortgage rates have started to rise (which involves the Federal Reserve, monetary easing, and a bunch of stuff we learned in college but don’t remember), and that’s always an important factor in home-price increases. Home buyers want to lock in the lowest rate possible, and so they’re willing to pay more money for a house if they can buy it before interest rates go up.

There is one caveat in all this, I was told. Most of the real estate statistics that point to the spectacular, double-digit increases cover areas much larger than our neighborhoods or even Dallas. One of them takes in 50 counties in North Texas, which makes it that much harder to pinpoint what’s going on where.

One final note: I didn’t call the Realtor about his critical inventory. I’m not sure he would have understood the concept of the dyin’ house.