This month’s topic — municipal finance!

For those of you who are still awake, this is a subject that doesn’t get nearly the attention that it deserves. It’s not as dramatic as police work or fire fighting; it’s not as interesting as arts funding or libraries; people don’t get passionate about it like they do about recycling and trash pickup or zoning controversies, but it’s basically how everything else gets paid for.

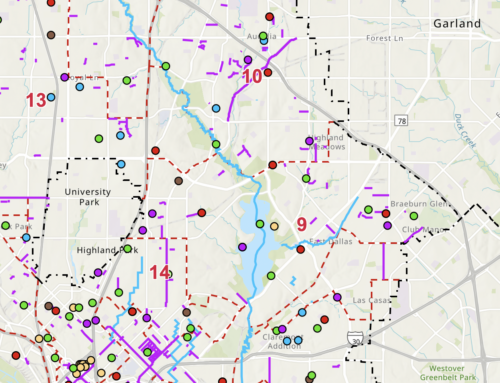

Right now, the city is long overdue for a municipal bond election. Bond package values of anywhere from less than $300 million to more than $600 million have been talked about, but given the city’s serious budget crunch right now, no one relishes the idea of going to the voters to approve a big debt issuance, so the bond election has been pushed back to, at the earliest, next spring some time.

The city of Dallas has had a AAA, or “triple A,” bond rating for as long as most of us can remember. In its odd and idiosyncratic way, Dallas has always been very proud of its AAA rating — sort of like “we may not have mountains or an ocean nearby, but check out our bond rating!” Not only has it been a source of civic pride as emblematic of a well-run city, the higher rating typically carries a lower interest rate and thus cheaper debt service, which over the length of multimillion dollar bond issues isn’t chump change.

The amount of bonded indebtedness outstanding impacts the strength of your bond rating, so the stodgy old conventional wisdom is that you don’t want to have too much debt floating out there at any one time. However, AA bonds are not much of a step down and would probably still be viewed pretty favorably, since any municipal bonds are ultimately backed by a city’s authority to levy and collect taxes. In light of all of that, plus the fact that market interest rates are low right now, there have been some rumblings, given the city’s needs, about going for a much larger bond package even if it means that the rating gets lowered, or worse, taxes go up a little.

So you can understand the stir when Standard and Poor’s, one of the major bond rating agencies, said that it might lower Dallas’ rating to AA not because there was too much debt outstanding, but because of concerns about, essentially, there not being enough. S&P’s concern is lack of upkeep of our infrastructure, leading to more expensive repairs later, not to mention being a less attractive place to live and do business. Hence, the tax base eventually declines. It’s sort of like what your mortgage company would think if you quit spending money on keeping up your house — sure, you’d have more money in your pocket now, but how about the value of their security interest later when your house falls down?

It’s obvious how pressing the needs are — every time I drive down Henderson Avenue, it’s like going over a cement washboard. Live Oak and a lot of our other streets aren’t any better, not to mention the vast amounts of work needed on our parks and the rest of our infrastructure. Some communities get this — Frisco, one-twentieth our size in population, just passed a $200 million bond package by a two to one margin.

It is a little troubling that, in order to play catch-up after years of being penny-wise and pound-foolish, we’ll have to use bond money, normally considered capital spending, to pay for stuff like street repairs which should more properly, in my opinion, come out of the annual operating budget.

But it’s a little late for that. It seems like our best bet now is to take advantage of the low rates, do a big bond issue, not worry about the rating and start catching up on fixing our city as an investment in our economic base and our quality of life.